Abstract

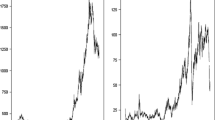

This paper investigates inter-relationships among the price behavior of oil, gold and the euro using time series and neural network methodologies. Traditionally gold is a leading indicator of future inflation. Both the demand and supply of oil as a key global commodity are impacted by inflationary expectations and such expectations determine current spot prices. Inflation influences both short and long-term interest rates that in turn influence the value of the dollar measured in terms of the euro. Certain hypotheses are formulated in this paper and time series and neural network methodologies are employed to test these hypotheses. We find that the markets for oil, gold and the euro are efficient but have limited inter-relationships among themselves.

Similar content being viewed by others

References

Aliber R (1966) The future of the dollar as an international currency. Frederick Praeger Publishers, New York

Barro RJ (1979) Money and the price level under the gold standard. Economic J 89:12–33

Bernanke B, Gertler M, Watson M (1997) Systematic monetary policy and the effects of oil shocks. Brookings Pap Econ Act 1:91–157

Bhar R, Malliaris AG (1998) Volume and volatility in foreign currency futures markets. Rev Quant Financ Account 10:285–302

Binner JM, Bissoondeeal RK, Elger T, Gazely AM, Mullineux AW (2005) A comparison of linear forecasting models and neural networks: an application to Euro inflation and Euro Divisia. App Econ 37:665–680

Blanchard OJ, Gali J (2007) The macroeconomic effects of oil price shocks: why are the 2000s so different from the 1970s? Working Paper, MIT Dept of Econ

Bordo MD (1981) The classical gold standard: some lessons for today. Fed Res Bank St Louis Rev 63:2–17

Bordo MD, James H (2008) A long term perspective on the euro. Working Paper NBER

Bordo MD, Kydland FE (1995) The gold standard as a monetary rule. Explor Econ Hist 32:423–464

Bordo MD, Dittmar RD, Gavin WT (2007) Gold, fiat money and price stability. Working Paper, Fed Res Bank of St. Louis

Canjels E, Prakash-Canjels G, Taylor AM (2004) Measuring market integration: foreign exchange arbitrage and the gold standard, 1979–1913. Rev of Econ Stat 86:868–882

Carpenter C (2004) Gold may rise as dollar falls, oil price rallies, survey shows. Bloomberg July 18

Chinn MD, Frankel JA (2008) Why the euro will rival the dollar. Intern Fin 11:49–73

Diba B, Grossman HI (1984) Rational bubbles in the price of gold. Working Paper, NBER

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dunis C, Williams M (2002) Modelling and trading the eur/usd exchange rate: do neural network models perform better? Derivat Use Trad Regul 8:211–239

Eichengreen B (1992) Golden fetters: the gold standard and the great depression, 1919–1939. Oxford University Press, New York

Eichengreen BJ (2007) The breakup of the euro area. Working Paper, NBER

Elekdag SA, Lalonde R, Laxton D, Muir D, Pesenti PA (2008) Oil price movements and the global economy: a model-based assessment. Working Paper, NBER

Enders W (2010) Applied econometric time series, 3rd edn. Wiley, Hoboken

Engle RF, Granger CWJ (1987) Cointegration and error correction representation, estimation and testing. Econometrica 55:51–276

Finn MG (2000) Perfect competition and the effects of energy price increases on economic activity. J Money Credit Bank 32:400–416

Fujiki H (2003) A model of the federal reserve act under the international gold standard system. J Mon Econ 50:1333–1350

Giannini C, Mosconi R (1992) Non-causality in cointegrated systems: representation, estimation and testing. Oxford Bull Econ Stat 54:399–417

Goodfriend M (1988) Central banking under the gold standard. Carnegie Rochester Conf Ser Pub Pol 29:85–124

Hamilton J (1983) Oil and the macroeconomy since world war II. J Polit Econ 91:228–248

Hamilton J (1996) This is what happened to the oil price macroeconomy relationship. J Money Econ 38:215–220

Hanke S (2008) It’s all the fed’s fault. Forbes 11.10.08

Henning SL, Shaw W (2000) Future stock performance of oil and gas firms conditional on the imputed value of reserves. Rev Quant Financ Account 15:127–135

Herrera AM, Pesavento E (2007) Oil price shocks, systematic monetary policy, and the great moderation. Unpublished manuscript, Michigan St Univ

Hooker MA (1996) What happened to the oil price macroeconomy relationship? J Monet Econ 38:195–213

Hooker MA (2002) Are oil shocks inflationary? asymmetric and nonlinear specifications versus changes in regime. J Money Credit Bank 34:540–561

Hsiao C (1981) Autoregressive modeling and money causality detection. J Money Econ 7:85–106

Hsiao C (1982) Autoregressive modeling and causal ordering of econometric variables. J Econ Dyn Control 4:243–259

Jamaleh A (2002) Explaining and forecasting the euro/dollar exchange rate through a non-linear threshold model. Eur J Fin 8:422–448

Johansen S (1991) Estimation and hypothesis testing of cointegrating vectors in gaussian vector autoregressive models. Econometrica 59:1551–1580

Johansen S (1995) Likelihood based inference in cointegrated vector autoregressive models. Oxford University Press, New York

Kilian L (2008) A comparison of the effects of exogenous oil supply shocks on output and inflation in the G7 countries. J Eur Econ Assoc 6:78–121

Kondonassis A, Paraskevopoulos C, Malliaris AG (2007) The future of the U.S. dollar and its competition with the euro. Eur Res St 10:97–110

Krichene N (2008a) Crude oil prices: trends and forecast. Working Paper, IMF

Krichene N (2008b) Recent inflationary trends in world commodities markets. Working Paper, IMF

Lin W, Duan C (2007) Oil convenience yields under demand/supply shock. Rev Quant Financ Account 28:203–225

MacKinnon J, Haug A, Michelis L (1999) Numerical distribution functions of likelihood ratio tests for cointegration. J App Econom 14:563–577

Mileva E, Siegfried N (2007) Oil market structure, network effects and the choice of currency for oil invoicing. Occasional Paper Series, European Central Bank

Nakov A, Pescatori A (2007) Oil and the great moderation. Working Paper, Fed Res Bank of Cleveland

Portes R, Rey HM (1998) The emergence of the euro as an international currency. Working Paper, NBER

Acknowledgment

We are thankful to Joko Mulyadi for data collection, bibliographical search and computational assistance. Valuable comments were given by Bala Batavia, Marc Hayford and several conference participants. We are also grateful to anonymous referees of the Review of Quantitative Finance and Accounting for valuable comments during two substantial revisions that helped us improve considerably this version and to Professor C. F. Lee, Editor-In-Chief for great encouragement and support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Malliaris, A.G., Malliaris, M. Are oil, gold and the euro inter-related? Time series and neural network analysis. Rev Quant Finan Acc 40, 1–14 (2013). https://doi.org/10.1007/s11156-011-0265-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-011-0265-9